In the last sixty years, Africa no doubt has made undeniable progress toward the continent’s integration. From stronger regional institutions to growing cross-border trade, Africa is steadily building the foundations of the African Economic Community.

However, according to the 2025 African Integration Report, the road to full integration remains complex, uneven, and fragile in places.

The report presents a comprehensive assessment of the state and progress of regional integration across the African continent, tracking Africans’ progress on the trail to continental unity. It observes the continent’s efforts to remove borders, complement policies, and reinforce harmony among the social, political, and economic dimensions.

Developed under the African Regional Integration Index (ASRII) framework, the report offers a continental snapshot of where Africa stands in 2025, celebrating achievements, acknowledging bottlenecks, and providing decision-makers with insights to accelerate Agenda 2063 and the African Continental Free Trade Area (AfCFTA).

Burning Issues for Africa in 2025

Between 2023 and 2025, Africa’s integration process has been shaped by a mix of opportunities and challenges in today’s fast-changing world:

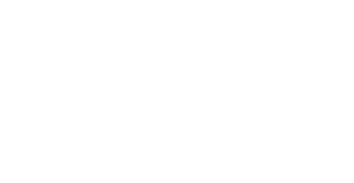

- Global Protectionism: Rising trade barriers, especially in the United States, have disrupted global supply chains and indirectly put pressure on African economies.

- Economic Challenges: Persistent inflation, rising debt, and reduced fiscal space limit the capacity of African countries to invest in transformative development projects.

- Digital Transformation: By the end of 2025, 40% of Africans are expected to shop online compared to 13% in 2017, with the e-commerce market projected at $180 billion by 2025 and $712 billion by 2050. However, poor infrastructure, weak regulatory frameworks, and unequal digital access remain major constraints to this.

- Declining Global Aid: The recent U.S. reduction of $163 billion in non-military spending in 2025, cut into contributions to the African Development Fund and USAID programmes, intensifying funding gaps for the continent.

These factors highlight why continental integration is both urgent and indispensable.

Key Findings from the 2025 African Integration Report

The ASRII assessment shows a moderately positive result in Africa’s integration, with progress in institutional, trade, and infrastructure dimensions, yet, disparities persist across regions and pillars of the continent:

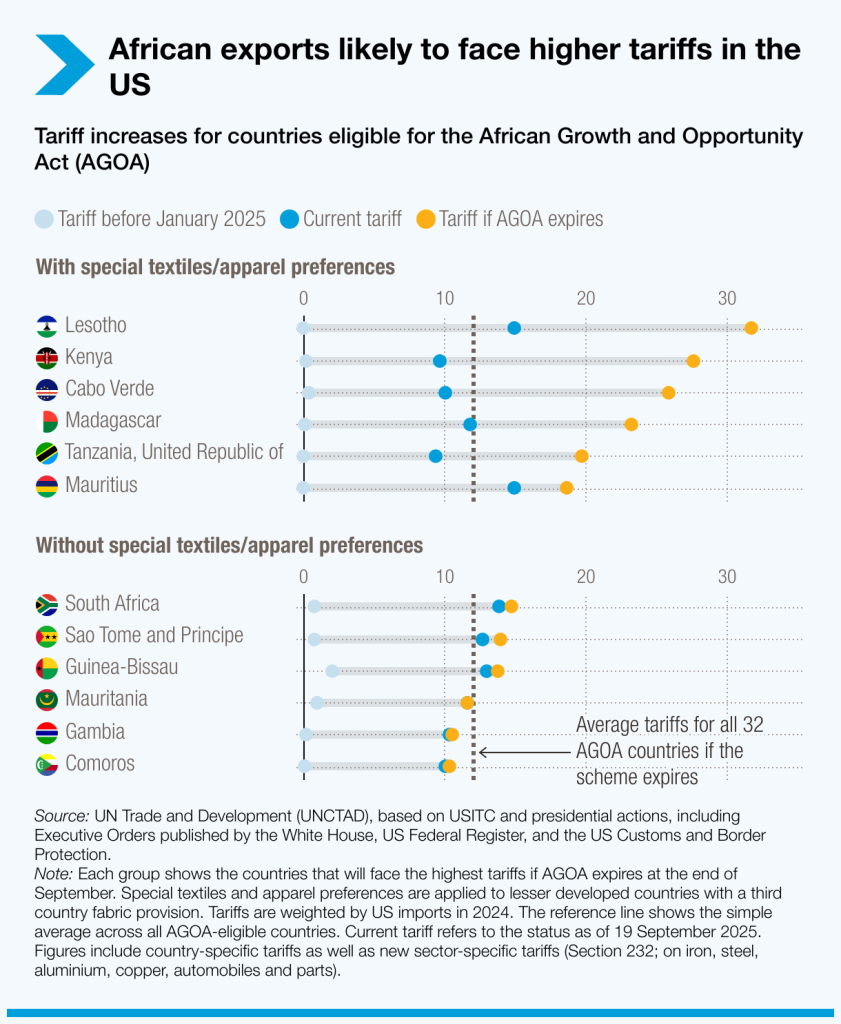

Institutional and Political Integration

- Strengthened by the ratification of the African Charter on Democracy, Elections and Governance (ACDEG) and the active role of the African Peer Review Mechanism (APRM).

- Peace and security initiatives, including the AU’s “Silencing the Guns” strategy, are yielding results in helping keep the peace of Africa.

However, many AU protocols remain unratified, and supranational institutions lack real enforcement powers to carryout strategic development policies on the continent.

Economic Integration

- Market integration scored strongly (0.590), thanks to AfCFTA implementation, tariff reductions, and one-stop border posts. Yet intra-African trade remains below 16% of total trade, far behind other continents.

- Industrialisation strategies and SME support are advancing but remain fragmented and underfunded.

Rural Economy Development

- Positive momentum with agro-industrial value chains and agricultural policies like ECOWAP (ECOWAS) and Climate-Smart Agriculture (COMESA).

- Average score of 0.69 in 2023 reflects progress in food systems resilience and agricultural investment frameworks.

Infrastructure Integration

- Strongest progress in transport and energy.

- Regional road networks, One-Stop Border Posts, and power pools (SAPP, WAPP, EAPP) are expanding cross-border connectivity.

- However, digital infrastructure remains weak and fragmented, with regional digital policies still in early stages.

Regional Snapshots

- ECOWAS leads in free movement of people and institutional strength, with successes like the ECOWAS passport and regional health systems.

- EAC shows high institutional maturity and strong governance, but weaker performance in social protection and monetary integration.

- SADC scores highly in infrastructure and governance, though gaps remain in fiscal and statistical integration.

- COMESA excels in infrastructure and institutional frameworks but lags in social cohesion and migration.

- IGAD remains a peace and security leader, though economic integration is still underdeveloped.

- ECCAS and CEN-SAD are making progress but remain fragile and uneven, particularly in social and human integration.

- AMU (North Africa) has untapped potential but faces political and institutional inertia.

Intra-African Trade Still have a Long Way to Go

Despite AfCFTA’s achievements, exports and trade within African account for just 15% of total exports, compared to over 60% in the EU. Trade is still concentrated in a few countries and primary goods, though manufactured products now represent 43% of intra-African trade.

If implementation accelerates, intra-African trade is projected to grow from $85 billion in 2023 to $101 billion by 2025. Unlocking this potential will require tackling persistent non-tariff barriers, infrastructure deficits, and limited productive capacities.

Accelerating Integration for Agenda 2063

The 2025 African Integration Report shows that Africa is on the move, building institutions, connecting markets, and investing in infrastructure. However, integration remains uneven, with significant slow pace in enforcement, social development, and financing.

To realise the aspirations of Agenda 2063 and make AfCFTA a transformative driver, Africa must deepen political will to ratify and implement AU protocols, prioritise digital and human capital integration alongside infrastructure, mobilise sustainable financing for regional institutions and projects and strengthen private sector participation, especially SMEs, in regional value chains.

The vision of an African Economic Community remains within reach. The next decade will determine whether Africa can translate its commitments into deeper integration that delivers prosperity, resilience, and shared growth for its people.