On Tuesday September 30, 2025, the African Growth and Opportunity Act (AGOA) officially expired. With the expiration of AGOA, the future of the US-Africa trade pact hangs in the balance.

Introduced by President Bill Clinton in 2000, AGOA offered duty-free access to the US market for eligible African countries.

For 25 years, AGOA opened doors and allowed a handful of sub-Saharan African countries duty-free access to the US market for certain products, including crude oil, precious stones, metals, and agricultural products like cocoa and textiles.

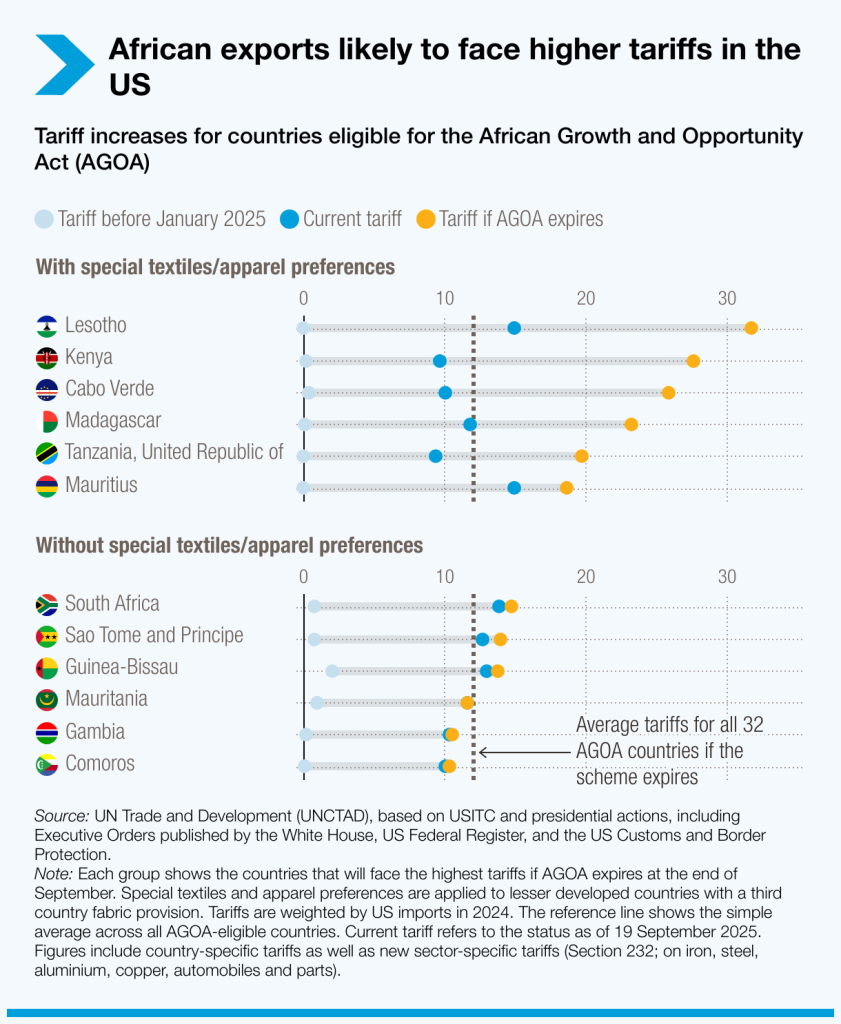

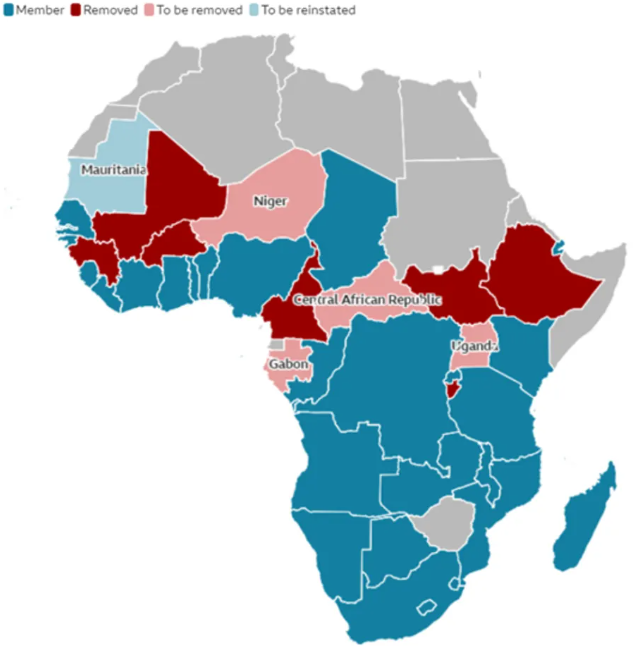

At its peak, only 32 of Africa’s 54 countries benefited from the agreement, exporting textiles, apparel, and other goods to the United States.

What African countries benefited from the agreement the most?

AGOA benefits accrue to a subset of countries and sectors within SSA.

According to Over three-quarters of non-crude petroleum imports under AGOA originated from five countries during 2014–21: South Africa generated about $2.7bn (£2.2bn) in revenue, mostly from the sale of vehicles, jewellery and metals, Nigeria came second with revenue of more than $1.4bn, from mostly oil, while Kenya came third with about $523m, according to a report by from the US International Trade Commission (ITC) and US Department of Commerce. others are Lesotho, Madagascar, and Ethiopia.

Countries with lower utilisation rates typically had few exports to the United States in general, or their primary traded goods are not eligible for AGOA preferences or are already duty free under normal trade relations.

The SSA apparel sector has benefited substantially from the AGOA program. Of non-petroleum imports under AGOA, imports of textile and apparel constitute the largest share. Duty savings of up to 30 percent and the third-country fabric provision have allowed multiple countries to expand their manufacturing capacity.

Agricultural products like cotton and cocoa are important sectors for a number of SSA economies. Growing these crops employs millions of farmers across the region, and their export is critical for accessing foreign exchange.

Cocoa processing operations in the region allow the export of higher-value commodities like cocoa butter and powder. However, growing cotton and cocoa provides low income and therefore does not provide a reliable pathway for poverty reduction.

Despite the SSA region’s access to ample feedstocks, the chemical industry’s potential impact across the region is limited, and substantial development will likely depend on mitigating competitive infrastructure weaknesses.

In 2023, US imports under AGOA totaled nearly $10 billion. African countries, such as Kenya, Nigeria, South Africa and Lesotho, the deal has been a cornerstone for US-Africa trade, But it also created dependency and reliance on exports to the US. Today, just 6% of Africa’s exports go to the US, while only 4% of imports come from the US.

The AGOA overall utilisation remained limited, even in sectors like textiles where it was most impactful.

While its expiration has sparked anxiety about jobs, exports, and trade relations, it should also spark deeper reflection on the part of African countries as a wake-up call to boost regional trade.

Dependency as Against Self-Determination

AGOA’s expiry is a reminder of a truth Africa cannot ignore: no external policy should define Africa’s economic destiny. While access to global markets is important, Africa cannot continue to rely on trade concessions that are subject to foreign political cycles.

Take Lesotho as an example. U.S. goods and services trade with Lesotho totaled an estimated $276.0 million in 2024, up 4.6 percent ($12.3 million) from 2023. That demand could easily fuel local and regional growth if the continent can fix its logistics, infrastructure, customs, and trade barriers.

Lesotho’s textile industry thrived under AGOA, yet the irony remains: why scramble for access to distant markets while Africa itself imports over $7 billion worth of textiles annually?

The question is not why Lesotho isn’t selling more to the US. The real question is: why isn’t Lesotho selling more to African countries?

AfCFTA: Africa’s Real Game-Changer

The African Continental Free Trade Area (AfCFTA) offers a far bigger opportunity than AGOA ever did. With a combined population of 1.4 billion people and a GDP of over $3 trillion, Africa already is one of the world’s largest consumer markets.

Yet today, less than 17% of African trade takes place within the continent, compared to intra-EU exports which accounts for 50% and 75% of the regions trade. The gap in intra African trade represents both a challenge and an opportunity. By prioritising intra-African trade, the AfCFTA could unlock billions in value, reduce external dependency, and build resilience against global shocks. But this requires action:

- Infrastructure: Roads, ports, rail, and digital networks that connect African manufacturers to markets on the continent.

- Policy and Governance: Streamlined customs, harmonised tariffs, and reduced bureaucratic bottlenecks can help boost intra-African trade.

- Financing: By closing the ₦13 trillion MSME credit gap that stifles innovation and growth across the continent, Africa can unlock growth and regional prosperity.

- Value Chains: Diversification into agro-processing, green energy, textiles, minerals, and digital services is essential in reducing overreliance on foreign markets and creating jobs for the millions of people on the continent.

As Dr Ngozi Okonjo-Iweala rightly put it during her chat with CNN’s Larry Madowo at the just concluded #UNGA80, Africa’s future lies in regional value chains and self-reliance. From shea butter to leather, textiles, palm oil, and critical minerals, the continent has everything it needs to build industries that create jobs and wealth at home.

This is already happening with countries beginning to ban raw material exports, choosing instead to keep resources like lithium, cobalt, and gold to power local industries.

But policy alignment must go further with encouraging trade within Africa before trading outside Africa. After all, no region in the world prospers by exporting first before meeting domestic demand.

Now is the time for Africa to move from raw material exports to value-added products. It’s also high time for stronger trade alliances within the continent.

Looking beyond AGOA

AGOA’s expiry should not be seen as an end, but as a turning point. Africa must now:

- Commit to AfCFTA implementation with urgency and seriousness.

- Invest in regional value chains that turn raw materials into finished goods on the continent.

- Create policies that unlock trade, rather than stifle it with ego, protectionism, and bureaucracy.

- Build self-confidence. Africa has the resources, talent, and creativity to shape its own destiny.

At ETK Group, we believe that Africa’s true opportunity lies within. We work with governments, businesses, and investors to build capacity, unlock market access, and strengthen trade ecosystems across 34 African markets.

AGOA may be over, but Africa’s story is just beginning. The future of Africa’s trade is not dependent on foreign trade policies but on Africa trading with Africa.